Debt Consolidation Loan

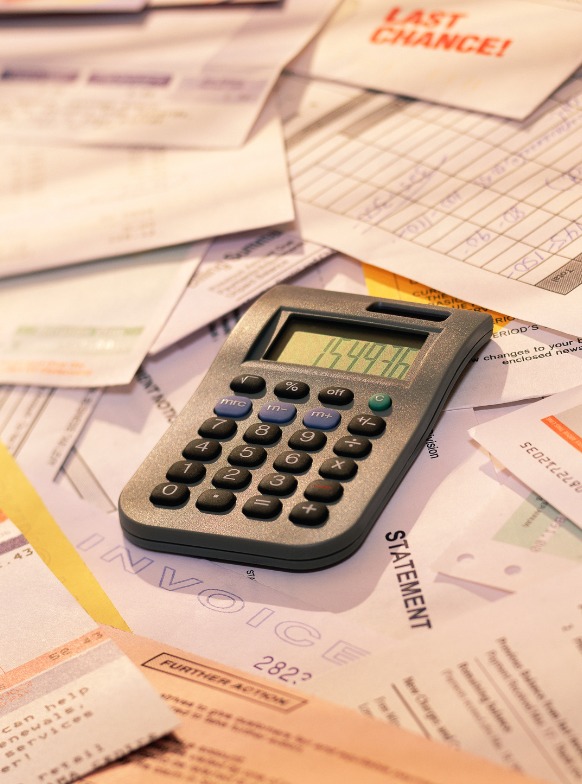

A debt consolidation loan is an installment loan with repayment terms usually lasting between two to five years. These loans are used to combine your existing debts into a single debt with one monthly payment. Debt consolidation can lower your monthly payments and allow you to save money on interest long term. Often, credit card debt or auto loans have higher interest rates than a debt consolidation loan. By combining multiple debts, you get one interest rate that is usually lower. Many people use debt consolidation loans to pay off credit cards, car payments, medical bills, and sometimes even student loans.

Overview

Utilizing a debt consolidation loan can help reduce the total interest you owe on your debt, and help you pay it off faster. It can also make paying down debt simpler, as you only have one monthly payment to account for in your budget.

The availability and interest rates of debt consolidation loans largely depend on your individual credit score. The better your score, the more options you have and the lower interest you’ll pay.

Debt Consolidation FAQs

What is the average credit score for a debt consolidation?

The typical average credit score for a debt consolidation is at least 650. The better your credit score, the easier it will be to qualify for a debt consolidation loan. The lowest score that may be accepted is 580.

What happens to all the debts with a consolidation loan?

In a debt consolidation loan, you are provided with the funds to pay off all your separate debts or any that you have chosen to consolidate. Then you are left with the loan to repay in monthly payments. The goal is to pay off debts that have higher interest rates and replace them with the lower interest loan. Debt consolidation does not eliminate debt but it does help lower interest paid over the long term and makes it easier to pay off debt by restructuring it into a single loan.

Do you need income for debt consolidation?

Since a debt consolidation does not eliminate debt, you will need some type of income or cash flow to make sure that you can make the loan payments. If you are unable to make the monthly loan payments, your credit score will be harmed.

What is a disadvantage of debt consolidation?

Before getting a debt consolidation loan, be sure to check if there are any penalties for paying off any of your debts early. There may be fees or added costs to paying off debts such as auto loans or credit cards. In addition, there are closing costs and fees that may cost you more when first obtaining a debt consolidation loan. Applying for a debt consolidation loan can also impact your credit score but should not harm it long term.

Does consolidation hurt your credit?

Since the lender has to pull a hard inquiry of your credit, this can affect your credit score. However, this is only temporary and it will not affect your score for more than one year.

Debt consolidation loans show up on your credit report for as long as you have the loan open. If you are reliable and make payments on time, this can be great for your credit score. If you are late making monthly payments, your credit score can be hurt as it would with any other debt.